[ad_1]

Final month, Tether issued its most recent quarterly assurance feeling. The issuer of USDT announced that its reserves now exceeded its liabilities.

This should really have eased issues around Tether’s position as the one arbiter of the world’s major stablecoin in market cap. Alternatively, it was achieved with combined evaluations, with some questioning the report’s authenticity and other individuals getting situation with the change in its reserve assets allocation.

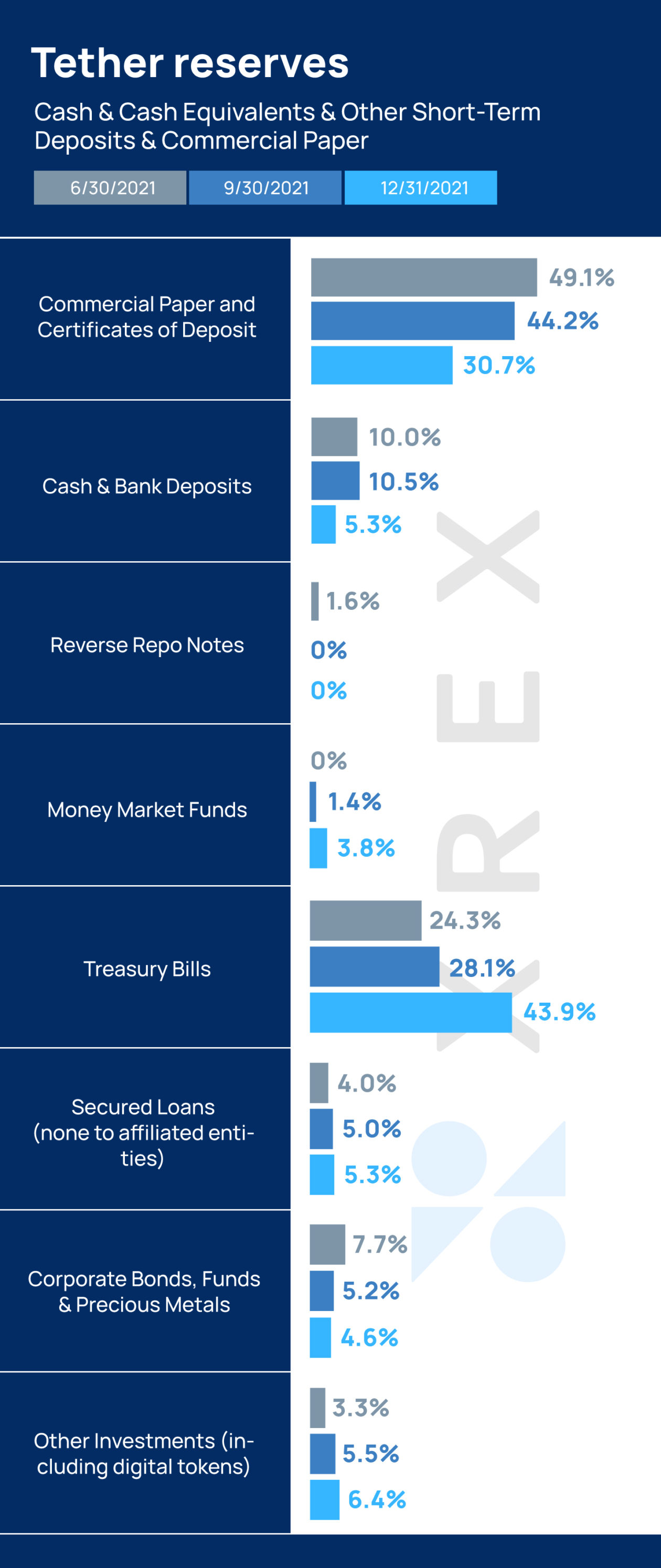

XREX has looked at Tether’s reserve belongings allocation and as opposed it with what we imagine varieties draft steering from the U.S. regulatory authorities. (Make sure you note that we are unable to confirm and comment on the authenticity of the audit independently, so we will make our case primarily based on the data disclosed by Tether.) We believe that that as opposed to just before, Tether’s present-day belongings allocation is nearer to what regulators are wanting for with stablecoin issuers. We would also argue that in spite of its reduction in cash, Tether’s collaterals have improved over the past two quarters.

From funds to money and T-bills

At the conclusion of 2021, Tether claimed its consolidated overall assets total to at the very least close to US$78.68 billion, even though its consolidated complete liabilities sum to about US$78.54 billion, of which about US$78.48 billion relates to digital token issuance. This signifies that what Tether has in property now outweighs the USDT tokens it has issued. But how different is the asset allocation now, and how’s the asset good quality?

In contrast to its report released in September 2021, Tether minimized its income and lender deposits by 42%, to US$4.187 billion, and its industrial papers by about 21%, from US$30.5 billion to US$24.16 billion. It greater its allocation to funds sector resources by 200% to $3 billion, and its Treasury expenditures by 77.6% to $34.52 billion.

This move could possibly have been considered as Tether lowering its “cash in the financial institution,” as a result subjecting itself to increased threat now that the USDT is backed by a lesser “bank deposit.” Some in the crypto neighborhood feel a lot more cozy with stablecoin issuers getting 1:1 USD deposits at business banking institutions, and this go was not been given effectively.

Having said that, Tether’s collaterals have improved its share of Treasury costs and lessened its exposure to industrial papers, which rely on the creditworthiness of personal organizations. By raising its share of superior-high quality liquid belongings, Tether is strengthening its liquidity below strain and going toward a a lot more resilient stablecoin.

Stablecoin dangers: run, payment technique, power concentration

In November 2021, the President’s Operating Team on Money Marketplaces (PWG) issued a report on stablecoins that highlighted regulatory gaps and outlined recommendations to tackle these gaps. The working group was led by Dr. Nellie Liang, the U.S. undersecretary of the Treasury for Domestic Finance and a seasoned economist who put in approximately 30 several years at the Federal Reserve prior to her present appointment. Her in-depth know-how of the fiscal process and her understanding of the stablecoin marketplace make it essential for the crypto neighborhood to go through how economists and regulators alike may assess the stablecoin market place.

The PWG report highlighted 3 crucial risks in the present stablecoin ecosystem, specifically: operate dangers, payment technique hazards, and focus of economic electric power. These hazards deliver about worries about liquidity and operational availability through a disaster. It also signifies the will need to lessen the focus of energy and raise interoperability. Listed here, we look at two of the risks highlighted: run threat and liquidity.

Asset diversification can minimize stablecoin risks

In her testimony to the Senate Committee on Banking, Housing and Urban Affairs on Feb. 15, Dr. Liang said: “History has proven that, devoid of sufficient safeguards, bank deposits and other types of private funds have the opportunity to pose hazards to shoppers and the financial process.”

Dr. Liang cited the hazard of a “stablecoin run,” where by people get rid of self-confidence in times of anxiety or uncertainty and hurry to withdraw or market their stablecoin property, placing off a wave that impacts the broader traditional finance process. We saw this in the course of the 2008 liquidity crisis.

If a stablecoin operate occurs and holders sell USDT en masse, it will bring about crypto exchanges to massively redeem with Tether.

High-excellent liquid assets

There is a paramount want for Tether to personal higher-excellent property to handle two eventualities that will possible outcome in a operate: just one is in the course of a world disaster when persons hurry to liquidate their property as they prefer to have increased liquidity on hand to tide through, and two, when a operate versus Tether comes about.

The PWG report implied that stablecoins should be backed one particular-for-one particular by “high high quality liquid property.” When asked through her testimony to look at the threat of a operate in between a absolutely-reserved stablecoin as opposed to a fractional reserve lender, Dr. Liang reported: “For illustration, a funds market place fund — completely reserved, 100%, substantial-quality property — have quite limited reserve operate.” She also stated that fractional reserve banking can avoid operates if backed by deposit insurance coverage, financial institution of past resort, or lower price window facilities, and merged with regulation of the property.

On the other hand, it is obvious in this instance that in Dr. Liang’s check out, the larger sized the part of increased-good quality assets, the decrease the danger of a operate. In distinction, fractional reserve banking and the inherent leverage therein implies that professional banking institutions can encounter operate danger less than stressful circumstances leading to uncertainty concerning the availability of cash held as lender deposits.

The 2007-2008 economical disaster shown the vulnerabilities of the common banking procedure, including the perceived safety of industrial financial institution deposits. The environment commenced reeling from the subprime home loan disaster in 2007. In the subsequent yr, expenditure lender Bear Stearns confronted liquidity concerns thanks to their overexposure to mortgage securities and required a Fed bailout. Like Bear Stearns, Lehman Brothers was extremely exposed to property finance loan-backed securities and experienced the greatest individual bankruptcy in history. The firm’s overleveraged exposure experienced thrown them into a downward spiral versus a deteriorating monetary surroundings.

It was underneath this backdrop of money program tension that Satoshi Nakamoto revealed the historic Bitcoin white paper on Oct. 31, 2008.

The message “The Periods 03/Jan/2009 Chancellor on the brink of second bailout for banks” was enshrined on Bitcoin’s genesis block. This was Satoshi’s message to all of us, a warning about the vulnerability and precariousness of the standard banking technique.

It is increasingly crystal clear that Tether now needs to be very cautious and nimble with its reserve allocation, relying on today’s economic circumstances. Evaluating Tether’s reserve allocation will have to integrate brief- and prolonged-time period financial outlook, to make certain that any stablecoin issuer can satisfy its token liabilities in any current market situation.

Conclusion

For the reason that of the explanations outlined earlier mentioned, if Tether carries on on this route, it will reduce its challenges in periods of pressured marketplace disorders and keep on to be a secure anchor to crypto marketplaces, especially to the numerous DeFi assignments that are created on USDT.

We are at the cusp of looking at additional express legislation that will set parameters for stablecoin issuers. In his opening statement at a Senate Committee listening to, ranking member Pat Toomey commented on the PWG report indicating, “Rather than depend on the ‘flexibility’ of the present framework for depository institutions, which leaves entire discretion to bank regulators, it is the duty of Congress to style and design this solution.”

It is obvious from the hearings that U.S. lawmakers are interested in observing many USD-pegged stablecoins thrive, as that will even further bolster the USD as the dominant world-wide reserve currency. With that intention in brain, it is only a issue of time before we see extra regulatory frameworks becoming rolled out to foster and speed up the progress of stablecoin adoption.

Stablecoins will perform a critical job in cross-border payments, global clearance and settlements in the near future, and we will go on to keep track of their developments carefully, towards a future the place cryptocurrency operators and economic institutions operate hand-in-hand to produce increased economic inclusion to all.

[ad_2]

Supply backlink